The OLED-XL™ Advantage

![]()

ABOUT eMagin

Founded in 2000, we are the leading manufacturer of active-matrix Organic LED (AM-OLED) Microdisplays on Silicon. Our displays provide image performance surpassing LCD technologies and are designed and manufactured in the U.S.A.

![]()

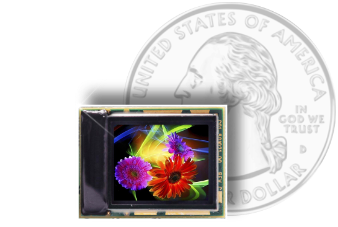

PRODUCTS

eMagin OLED Microdisplays offer solutions for military, medical, commercial/industrial and consumer markets including AR/VR applications.

![]()

MANUFACTURING OPERATIONS

Our industry leading OLED displays are produced in a state of the art manufacturing facility and cleanroom in New York State’s Hudson Valley.

![]()

TECHNOLOGY

With in-house R&D and Product Design groups, we are the leader in advancing OLED Microdisplay technology, featuring high brightness, low power and lightweight solutions. We offer superior resolutions and reliability across extended temperature ranges.

Press Releases

-

May 04, 2023

eMagin Demonstrates 15,000 cd/m2 Single-stack Full-color dPd™ OLED Microdisplay

Dec 15, 2022eMagin Receives $1.7M Order from Collins Aerospace

Dec 01, 2022eMagin Corporation to Exhibit at FLORetina ICOOR 2022 Conference

In the News

-

Jun 17, 2022

Printed Electronics Now